It’s a conundrum for news leaders: Finding time to keep up with the critical industry trends, while juggling the always-on demands of covering the news of the day. That was true even before 2020 brought us a global pandemic and a long overdue reckoning on race. But there really are a few reports each year that, to paraphrase from Wayne Gretzky, point to ‘where the news industry is going, not where it’s been.’ The annual Reuters Digital News Report, which surveyed 80,000 news consumers globally across 40 countries, is one. So, in case you are a member of the TL:DR (Too Long, Didn’t Read) club, here are my top takeaways from the just-released study. Some of the news is good, some bad, and some ugly.

1. Audiences Surge, Especially on TV

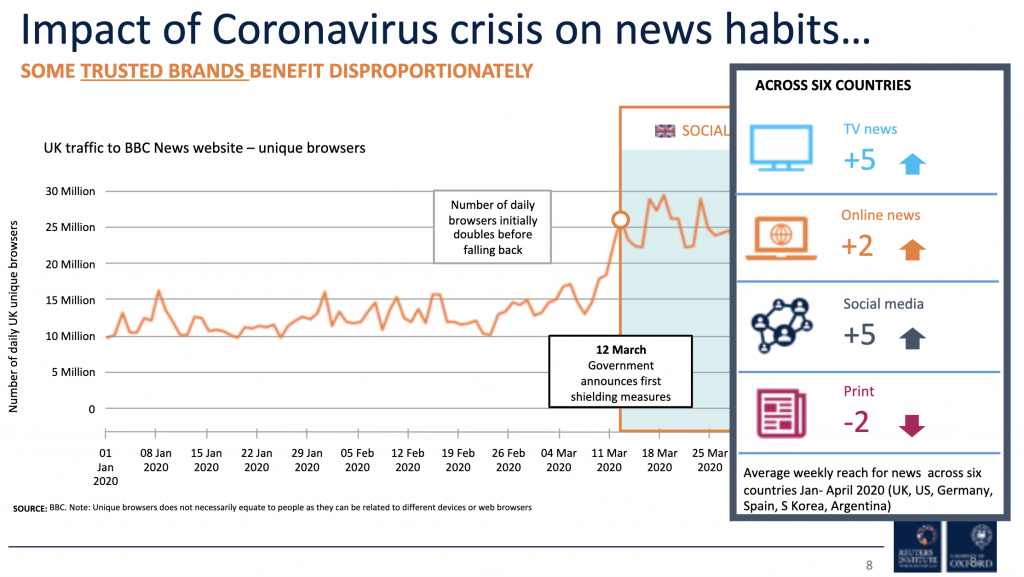

TV news viewing has been the biggest beneficiary of the surge in information-seeking, along with a comparable rise in use of social media. The Reuters findings align with research we previously reported on by SmithGeiger, showing that local TV news saw the largest gains in audience in response to the pandemic. Online news traffic is up but by less; and print has declined even further. “More people [during the pandemic] identified TV as their primary source of news,” the report found, concluding that the effects of the pandemic will likely be to “speed up, not slow down, the shift to digital.”

2. New Business Models are Lagging

Broadcasters saw during the second quarter of 2020 how much the TV business remains dependent on advertiser revenue, as the pandemic ravaged ad budgets. The Reuters report found the same effects for digital news, where new online revenue sources aren’t keeping up with advertising losses. TV and online audiences may be up during the pandemic, but ad revenue is down. Whether it’s closures for some local newspapers or hiring freezes, furloughs or layoffs at local broadcasters, the legacy ad-based business model for news remains the urgent problem to be solved.

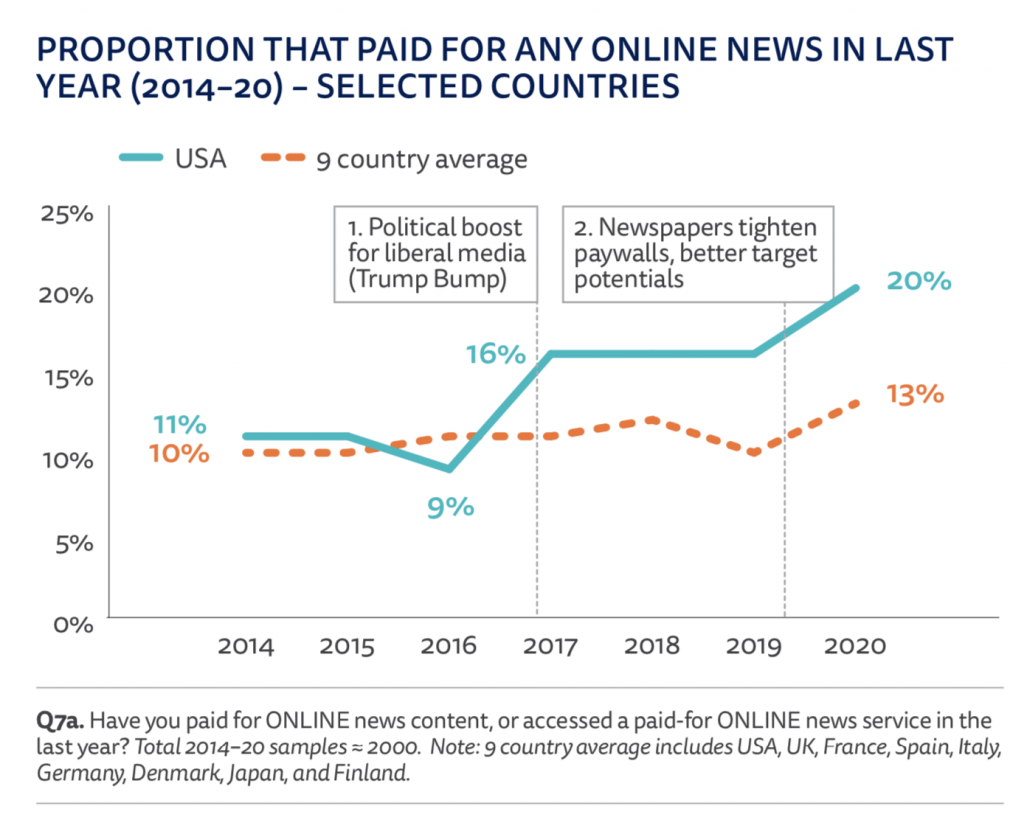

Newspapers have been leading the charge to transform toward a digital/subscriber model. The 2020 Reuters report shows modest global growth (20% of U.S. respondents said they paid for at least one news subscription, 50% higher than the global trend) but nowhere near the scale needed to create more stable funding for news.

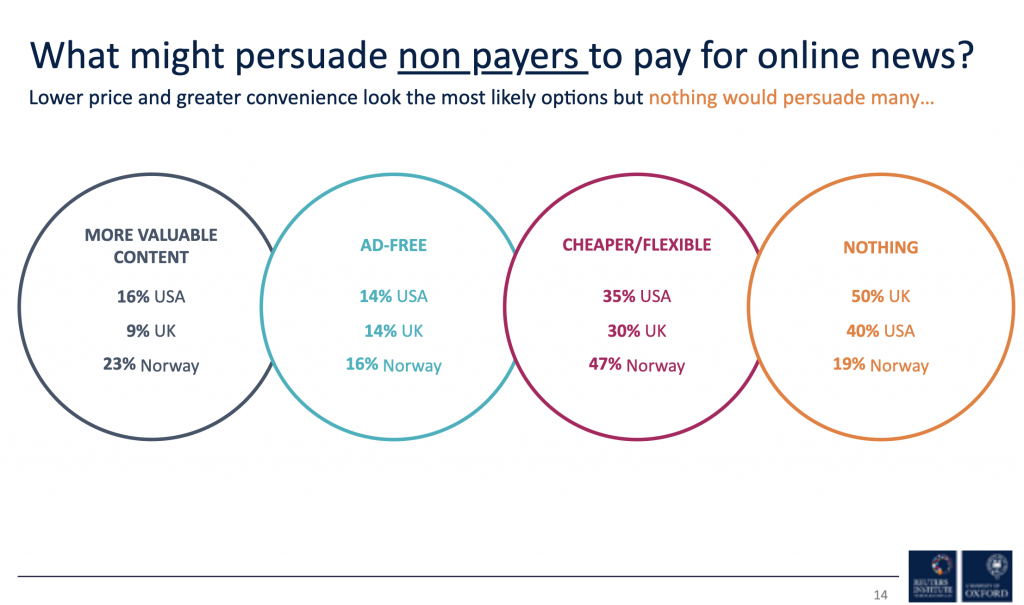

When non-subscribers were asked which features would entice them, a few opportunities emerged: Truly distinctive, “premium” content; and ad-free experiences along with ‘tiers’ of access. Each of these areas is ripe for experimentation. However, the most common response — 50% – said “nothing” would get them to pay for news, underscoring the pervasive consumer expectation that news should be ‘free.’

3. Decline in Trust in News is an Existential Threat

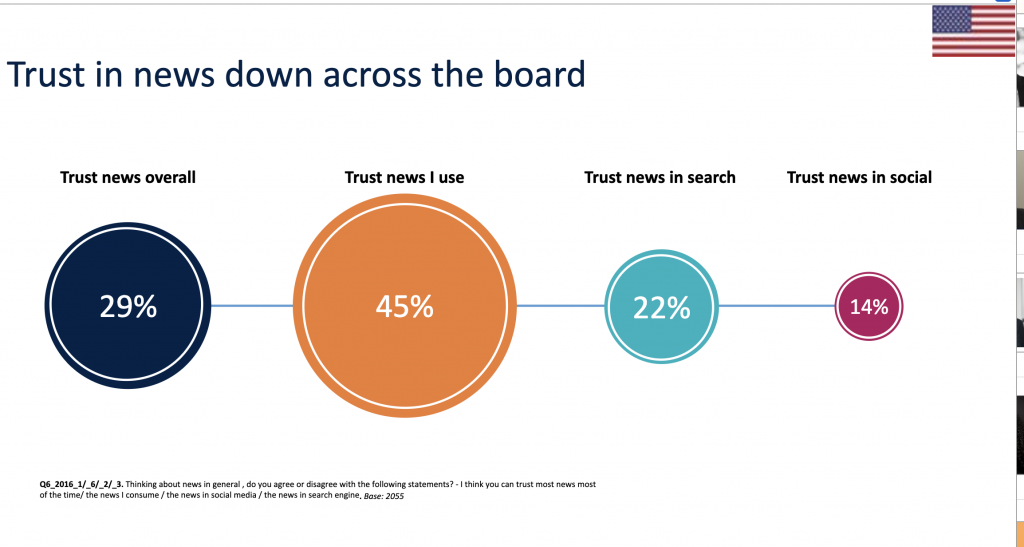

Basic credibility now appears to be an existential threat to journalists, perhaps second only to the industry’s revenue model challenges. Journalists accept at face value that credibility is their core currency, their essential value proposition. Yet for a commingling of reasons, the norm now is distrust in media.

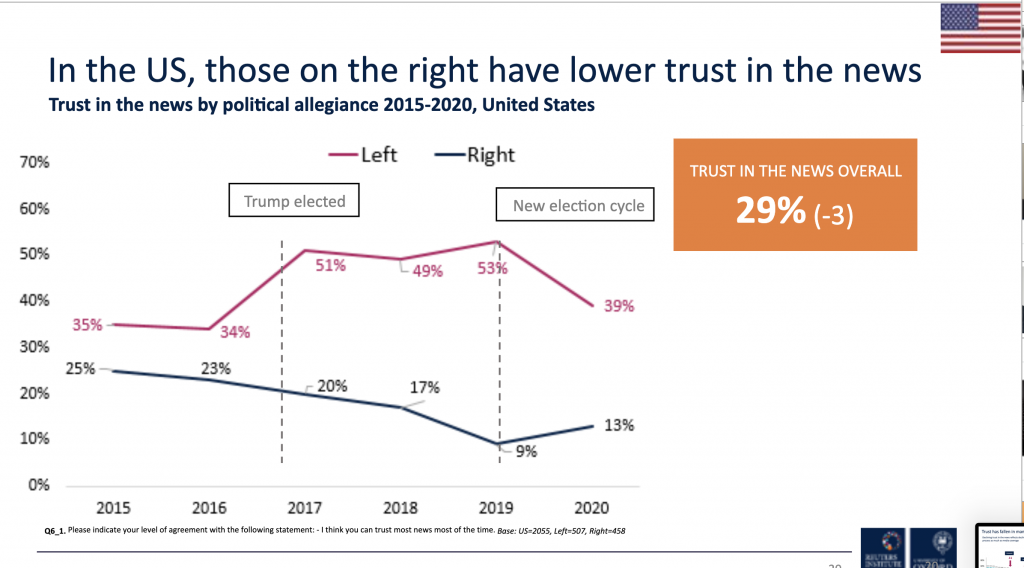

The Reuters report found that, In the United States, the hyper-partisan political climate has accelerated a division in trust based on party affiliation.

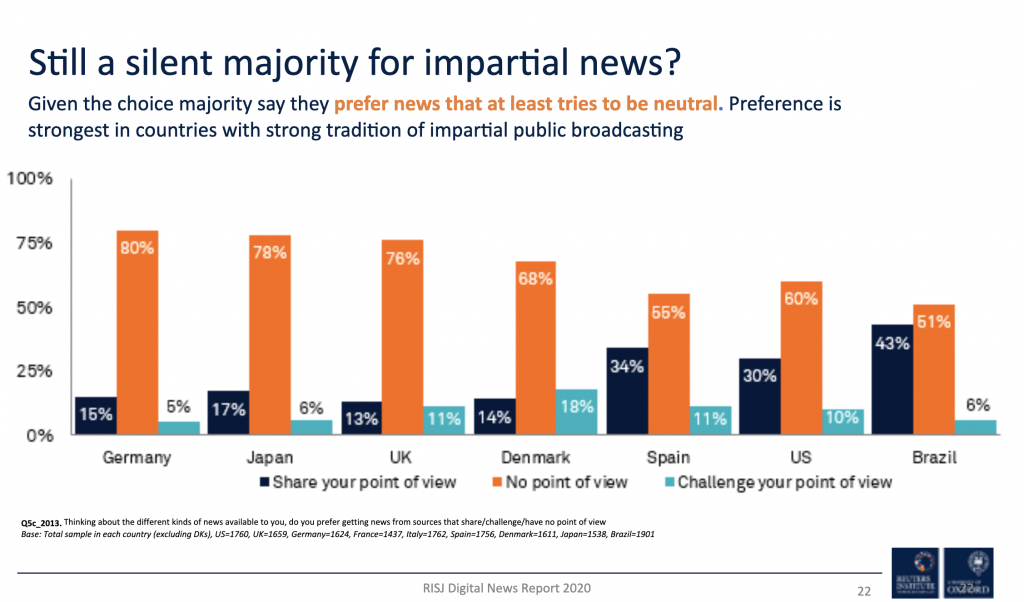

Journalists who assume everyone shares the view that news should be impartial — fair and accurate — may be both surprised and concerned to learn that fully 30% of Americans report preferring a news source that “shares their point of view,” rather than a news organization that “at least tries to be neutral.”

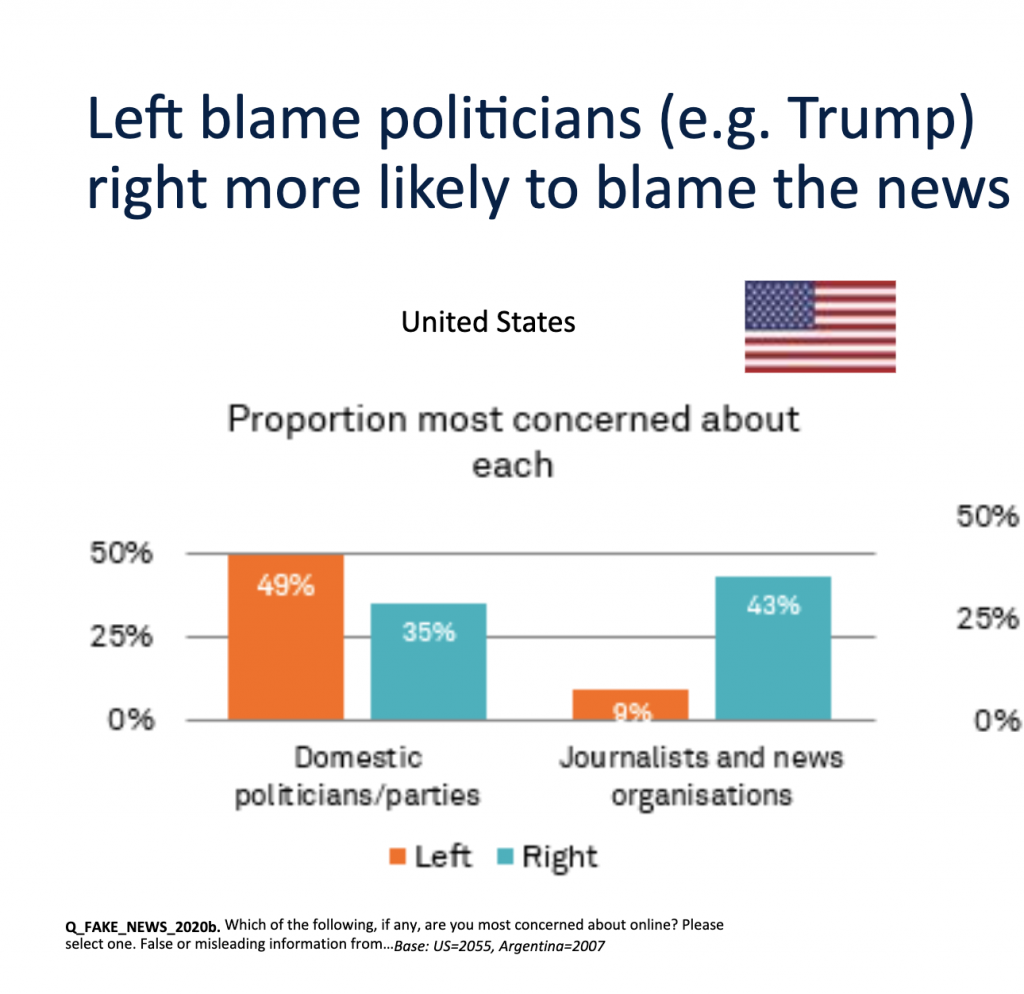

The Reuters report shows how the rise of misinformation has compounded this crisis of trust. By a large majority, respondents considered their own country’s politicians as the greatest source of misinformation (40%), well ahead of friends, media, foreign actors and leaders of other countries.

These global trends had a notable exception: In the U.S., Democrats saw politicians as the largest source of misinformation, but by a large margin Republicans in the U.S. identified journalists as the primary source of misinformation.

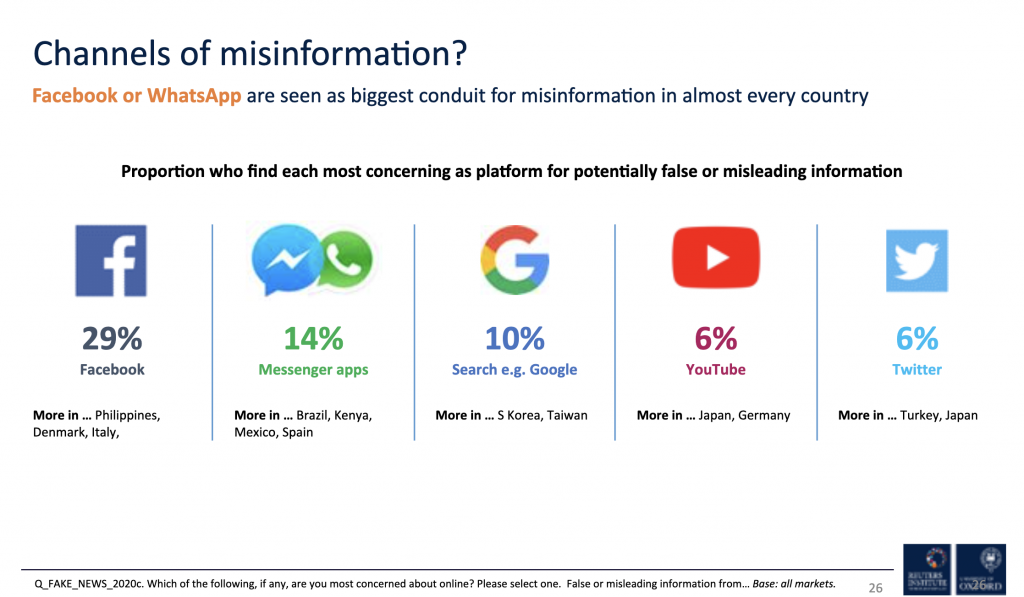

There’s also a growing recognition among news consumers of the role that platform and social media companies play in amplifying misinformation. Among platforms, Facebook is seen as the biggest channel for misinformation globally, at 29%; Facebook fares even worse among U.S. news consumers, with 35% rating it as the most concerning platform for misinformation.

The Cronkite News Lab previously reported findings by SmithGeiger that, in relative terms, Local TV News earned highest marks for trust. Nevertheless, these global trends around decline in trust represent a serious threat to journalism.

4. News is distributed more than ever

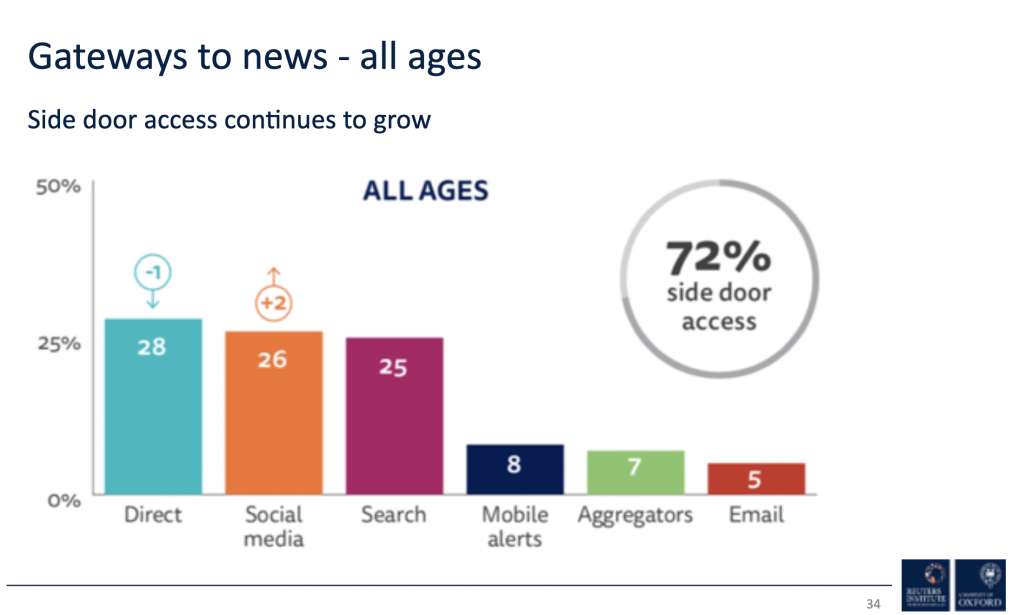

The final key takeaway from the Reuters report is about how consumers find news. Arguably the top headline of this year’s Reuters Digital News Report is that the ‘pathways’ to news are now fully distributed. Direct visits to news sites are virtually equal to news discovery via social and news discovery via search. These shifts have happened incrementally over time but, taken in aggregate, represent a transformational ‘new normal’ where a news organization must be distributed in its content discovery strategy if it hopes to be “seen” by the audience.

Noteworthy niche gateways include: Mobile alerts, newsletters, and podcasts.

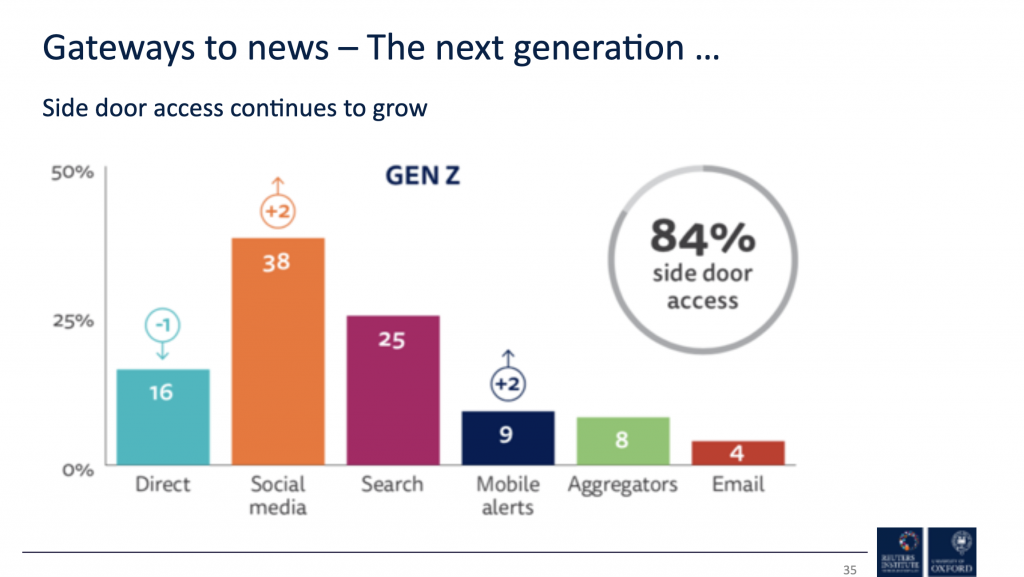

And news leaders looking to be like Gretzky and ‘skate to where the puck is going’ should memorize the “Gateways to News” data for Gen-Z audiences, where fewer than one in six primarily go directly to a news brand.

These findings also point to the areas of opportunity: Email newsletters, podcasts, and alerting via mobile/text are methods of cultivating deeper and direct audience relationships, and offer new opportunities for monetization as well.

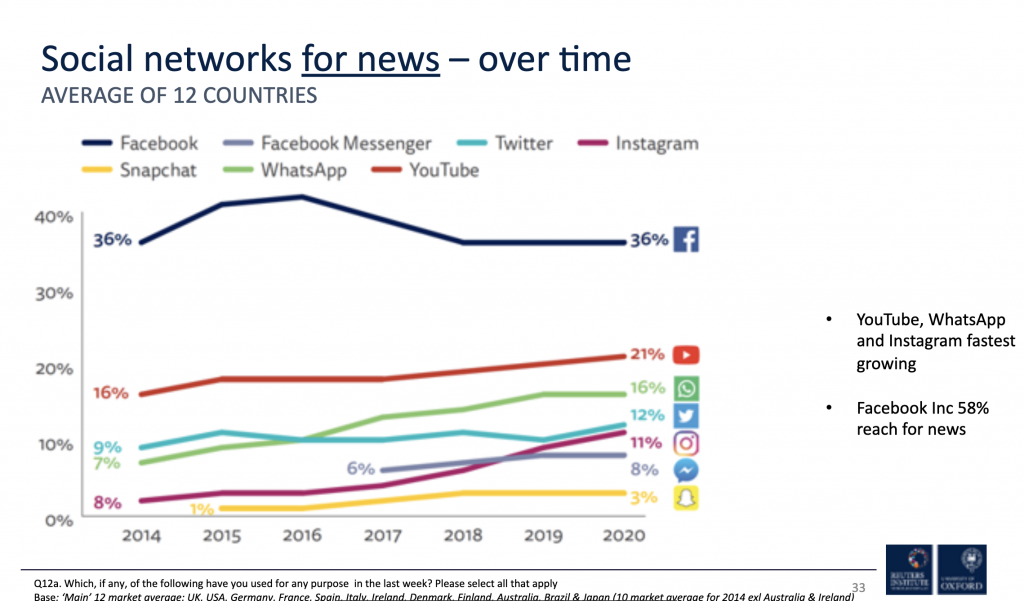

Among social networks, Facebook remains first as a source for news, but it has declined since its peak in 2016-2017, due in part to algorithm changes re-prioritizing ‘family and friends’ content. Perceptions of misinformation on the platform may also account for the drop.

Since 2014, YouTube has consistently grown as a source for news and remains number two globally. While Twitter has remained steady as a platform for news in the U.S., WhatsApp has overtaken it globally, and Instagram continues to rise as well.

The Path Forward

Each of the key takeaways from the Reuters 2020 report offers the opportunity to have strategic conversations in the newsroom to chart a sustainable path forward:

- Audiences have turned increasingly to trusted brands when information matters, especially TV news. That’s good news. How can your newsroom convert those extra visitors to loyalists?

- The weakness of the advertising-based business model has been further exposed by the economic impacts of the pandemic, and new approaches like subscriptions and tiered services, while growing, aren’t enough. The strategic challenge is to develop experiences and products audiences value enough to be self-sustaining, and to continue to diversify revenue sources.

- Trust in media is a serious threat, and newsrooms must double down on best practices regarding transparency, authenticity and fact-checking to maintain credibility upon which our profession depends.

Paths to news are now fully distributed, with direct visits simply one part of an “information ecosystem.” News outlets must be able to meet their audiences when and where consumers choose, and have monetization strategies tailored to match the method of distribution. Audio briefings, mobile alerts and email newsletters are promising examples of new ways to connect with news consumers.

Want to read more? Here’s the full 112-page 2020 Reuters Digital News Report.

Watch a recap video of the Digital News Report 2020